Wipro Ltd, one of India’s leading technology services companies, has been experiencing a sharp decline in its share price in recent months. This has caused concern among investors who are wondering what may be causing the drop and what the future holds for the company. Wipro has a long history of success in the technology services industry, but the question why is wipro falling in recent months has left many investors uncertain about the company’s future prospects.

In this blog, we will explore the primary reasons why is Wipro falling and examine the potential for a rebound in the future. We will analyze the company’s financial performance, the state of the IT industry, and any other factors that may be contributing to the decline. Additionally, we will consider the positive aspects of Wipro’s performance, such as its order book growth and potential for future revenue growth. By examining all these factors, we can gain a better understanding of the current state of Wipro and what the future may hold for this technology giant.

Reasons Why is wirpo falling in march 2023 ?

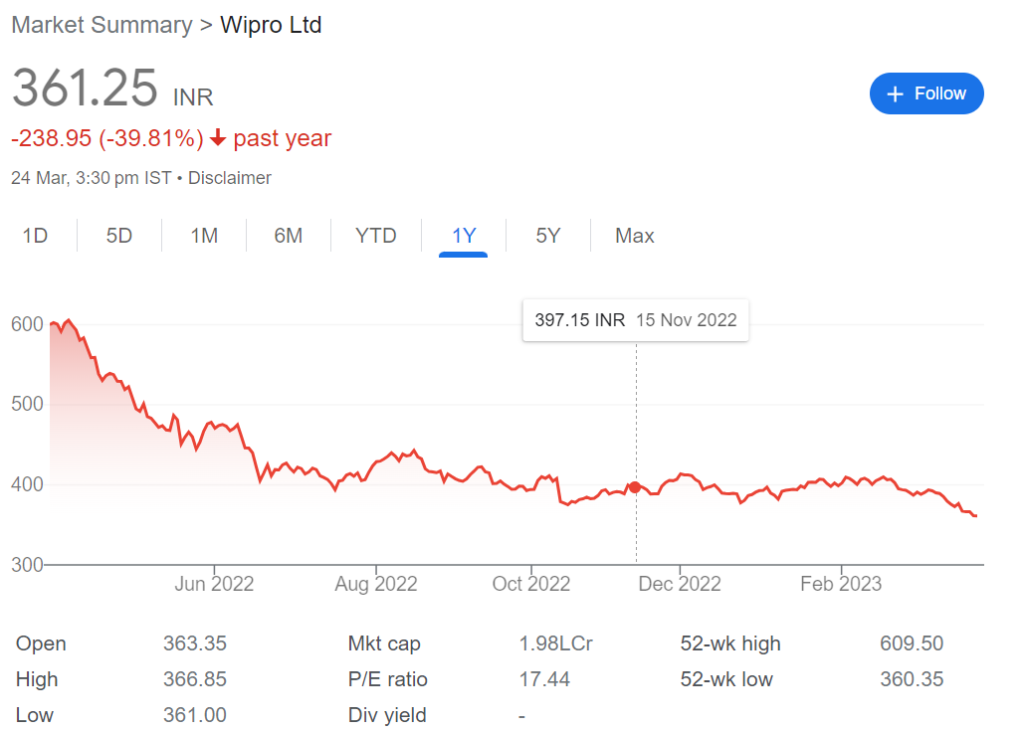

The primary reasons for why is Wipro falling its share price are multifaceted. One of the most significant factors is the company’s poor financial performance. Wipro has missed quarterly profit estimates and has forecast weak revenue growth, which has resulted in a decline in its share price by more than 5%. This poor performance has been attributed to various factors such as rising costs, higher expenses, and slower sales growth. Additionally, the company’s profitability has also been negatively impacted by increased competition in the industry.

Another contributing factor to the decline in Wipro’s share price is the uncertain demand for IT services. The IT industry is bracing for an economic downturn in the US and Europe, making it harder for IT firms to generate big deals. The increasing global economic uncertainty has resulted in a slowdown in business investments, and many organizations are being cautious with their IT spending.

Furthermore, Wipro’s profit after tax for Q2 2022 declined by 9.3% YoY, causing concern among investors. The decline was lower than expected, and it has raised concerns about the company’s ability to maintain its profitability levels in the long term. This has led to a reduction in investor confidence and a decline in the company’s share price.

Future Outlook

Despite the decline in Wipro’s share price, there is a buying opportunity for investors. Experts suggest that the decline in share price presents a favorable time to invest in the company, as the company’s order book grew 24% YoY in Q2. This indicates that there is still strong demand for Wipro’s services, and the company is well-positioned to capitalize on future opportunities.

The growing revenue and order book also suggest that there is potential for a rebound in Wipro’s share price in the coming months. While the stock has fallen significantly over the past year, the company’s strong fundamentals and robust order book provide a positive outlook for the future. This suggests that the company may recover from its recent financial difficulties and achieve greater success in the long term.

Moreover, Wipro has also made several strategic investments in the recent past to expand its offerings and boost its market share. These investments will likely position the company well to capitalize on future growth opportunities, thereby helping to drive future revenue growth.

Conclusion

In conclusion, Wipro’s falling share price is a result of the company’s poor financial performance and the uncertainty surrounding demand in the IT industry. However, the company’s growing revenue and order book indicate strong demand for its services and suggest a potential rebound in the coming months.

Despite the recent decline, investors should consider this as a buying opportunity and keep an eye on the company’s performance in the future. With Wipro’s strategic investments and focus on expanding its offerings, the company is well-positioned to capitalize on future growth opportunities and achieve long-term success.

Therefore, while the current market conditions may be challenging, Wipro’s fundamentals and potential for growth provide a positive outlook for the future, and investors should consider this when evaluating the company’s prospects.

Why is Wipro falling today ?

The IT major reported disappointing numbers, which included a slowdown in its consulting business due to macro uncertainty and geo-political tension. That is the reason for constant decline of Wipro in march 2023